C&D International: Diamond in the rough

Despite slowness in the China property industry, one smaller but nimble SOE developer known as C&D International managed to navigate the difficult years relatively unscathed.

The restructuring of Vanke continues to plague China’s real estate industry. Property developers have been stuck in the rut of a property downcycle even while broader Chinese consumption is showing signs of recovery lately. Averting the fate of its large peers like Evergrande and Country Garden, Vanke managed to come out ahead in a close call to extend their bond grace period. However, even as a SOE property developer backed by the Shenzhen Metro Group, state support itself is likely not enough to weather the prolonged cash crunch facing these debt-laden companies.

With much of the developments in the China property industry well-televised, one smaller but nimble SOE developer known as C&D International managed to navigate the difficulties relatively unscathed. With a market capitalization of US$4.5b, this Fujian Province company maintained its share price through recent years despite facing industry-wide challenges. As the real estate arm of Xiamen C&D Corporation Limited, the company was listed a decade ago from a capital market transaction with the former South West Eco Development Limited on the Hong Kong Stock Exchange.

Right now, C&D International is engaged in both real estate development as well as what they call industry chain investment services, pursuing asset-light strategies both upstream and downstream. Its property management group was spun off and likewise listed on the Hong Kong Stock Exchange since 2020 but re-consolidated just two years later to reposition the company as an integrated real estate business. Prudent capital management and cost discipline have allowed the company to weather the slowdown and remain profitable the past few years.

Hangzhou, Beijing, Xiamen and Shanghai continue to be the key cities driving business contributions. Furthermore, all the mentioned cities except Beijing remain as the highest land reserves for the company, with Shanghai topping their landbank at over one million square meters of saleable gross floor area. In this regards, C&D International will be able to benefit from the ongoing divergence of sales performance between top-tier cities and lower-tier cities as higher unit selling price per square meter is achieved in the more resilient core cities. A respectable gross margin of almost 13% for the latest project revenue they recognized also provide them room to weather further softness in residential demand if weakness materializes.

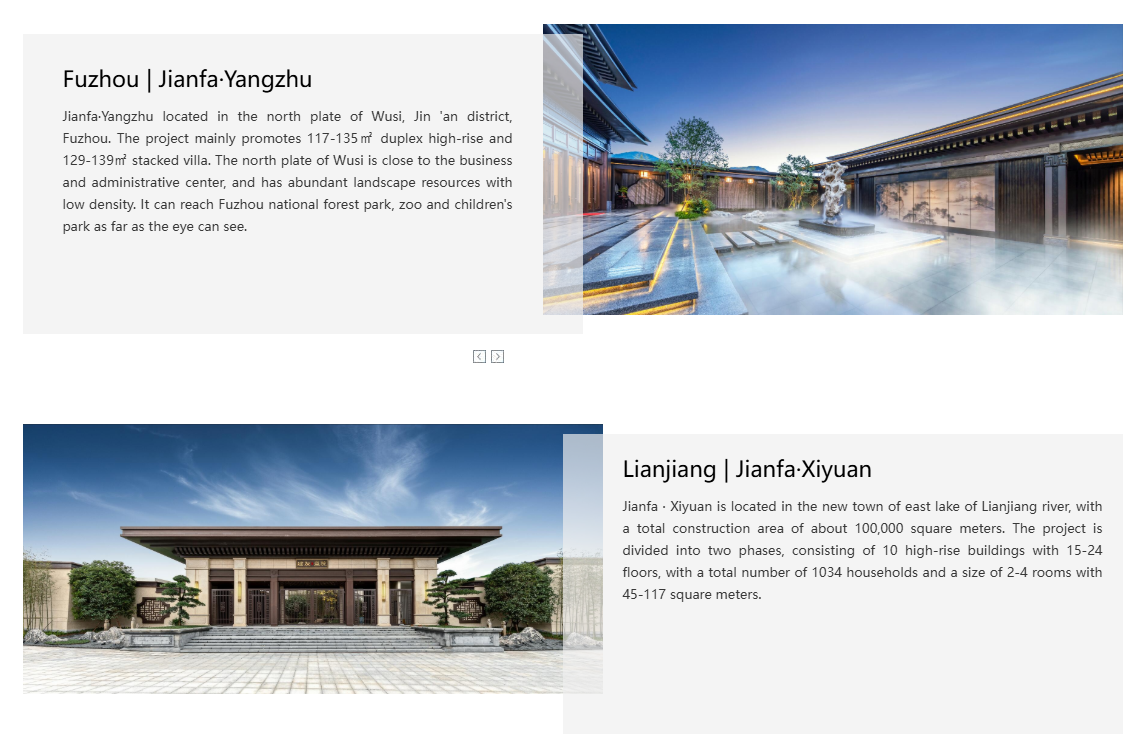

On their housing products, C&D International has earned itself a credible reputation of providing high-quality homes through their four major product series known as ‘The Essence‘, ‘The City’, ‘The Visionary’ and ‘The Nature’. Adhering to traditional Chinese styles with modern comfort, their homes are widely popular and aligned with the taste of Chinese homebuyers. The cultural qualities of their ‘neo Chinese style’ products are well sought-after by higher-income discerning buyers, enabling the company to gain slight pricing power compared to peers and lowering the risk of stagnant or slow-moving housing inventory which may lead to increased pressure for inventory clearance.

Lastly, the admirable balance sheet strength of C&D International is also translating to optionality and the ability to invest into a downcycle. Seizing opportunities in premium land parcels, the company forged ahead with the replenishment of their landbank despite industry woes and thus, a majority of their current land reserves are sites acquired in the last three years. This will place them in pole position for riding any potential industry recovery in the not-too-far horizon.