Giant Biogene: Adapting to a new retail landscape in China

For Giant Biogene, securing a key piece of the rapidly-growing skin rejuvenation market will help the company diversify its sources of income given the competition in broader skincare.

For much of China’s consumption drive, the beauty industry had grown at breakneck pace. It was not until the past few years that we witnessed certain shake-up, from the uprising of local brands versus foreign global brands to the evolution of beauty standards and products within Chinese consumers. Particularly in the skincare segment, new innovation has led the way for more niche functional skincare and even active cosmetics.

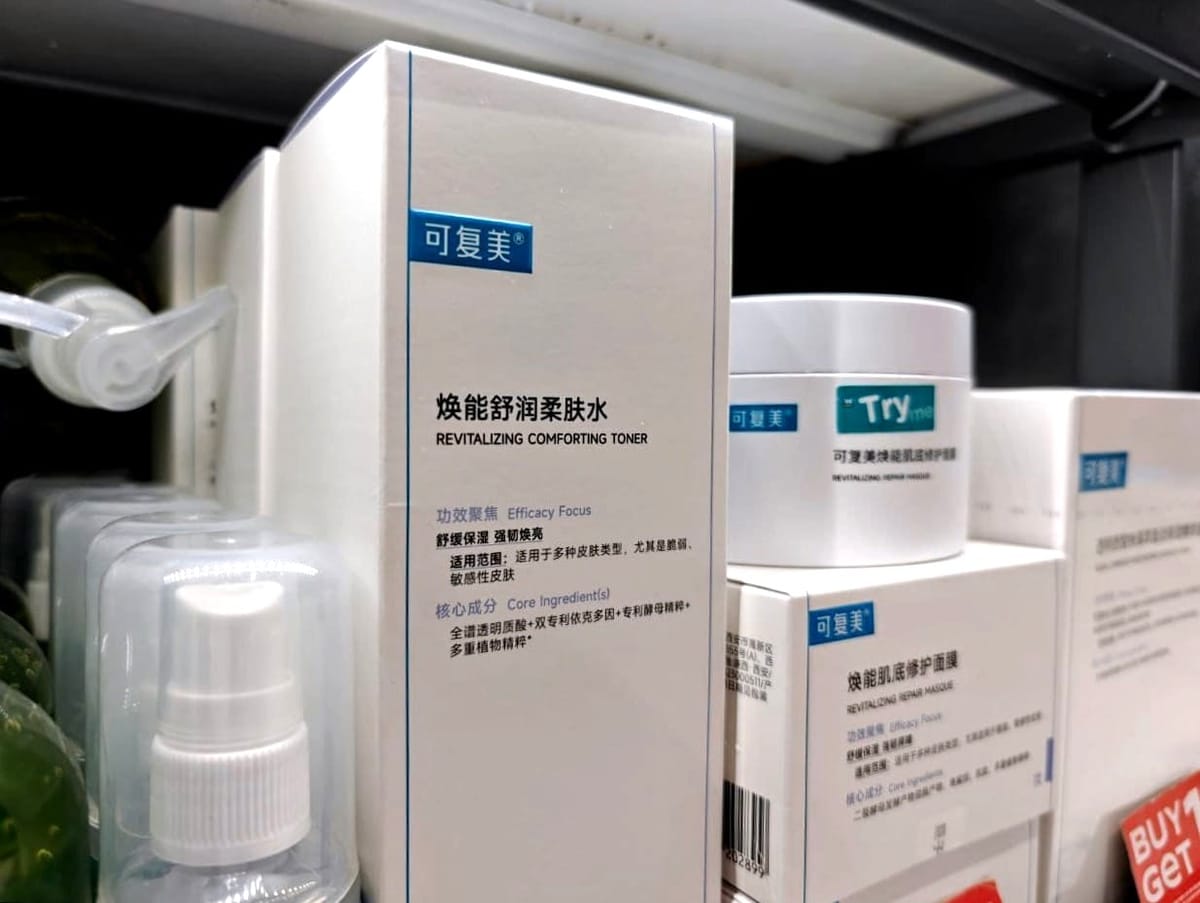

Giant Biogene, with its flagship brands Comfy and Collgene, primarily targets this functional skincare market though its pioneership of recombinant collagen as their key bioactive ingredient. They have successfully gained market share over the years since 2021 against other bioactive ingredients such as hyaluronic acid. The company defines their products as professional skin treatments, offering distinction from the wider skincare industry which is largely dominated by general skincare on the mass end, and skin rejuvenation applications (again, mainly hyaluronic acid and botulinum toxin) on the specialized end.

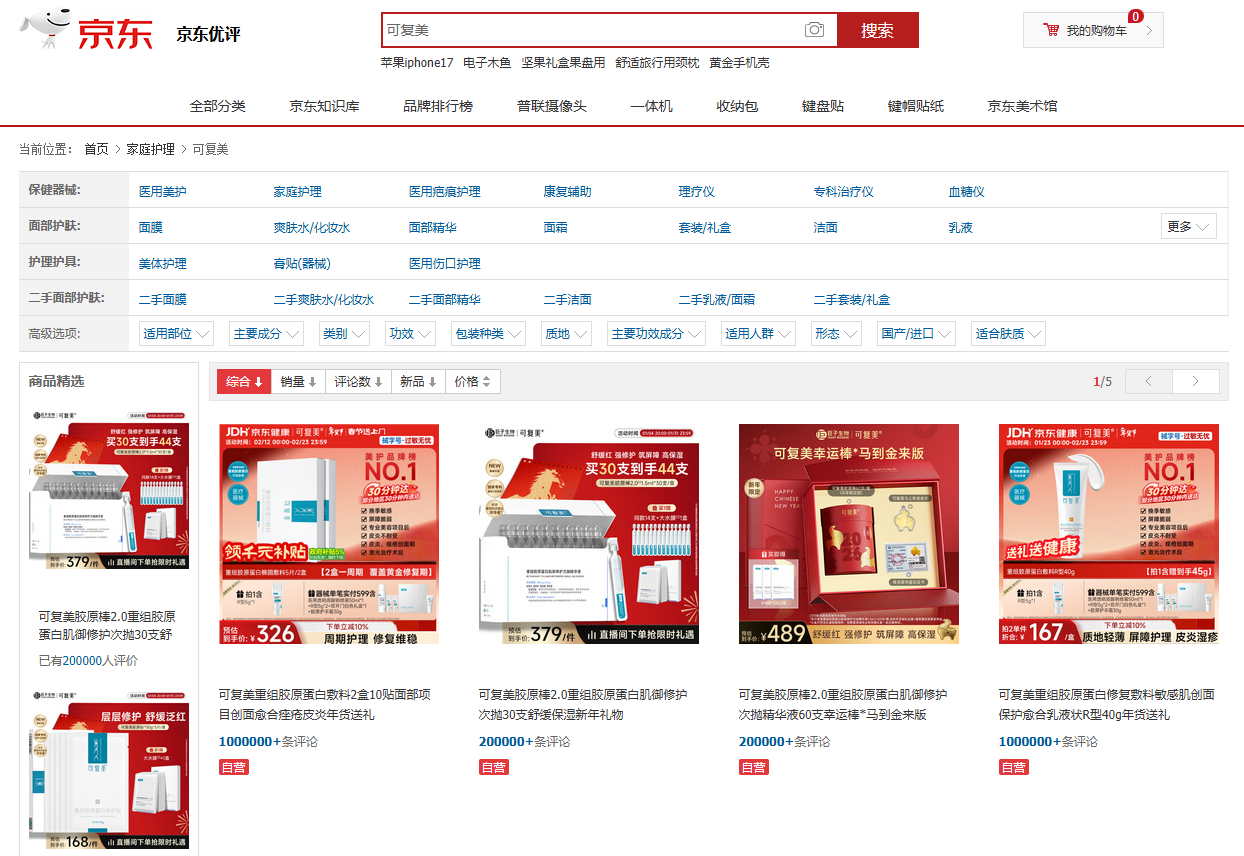

Although Giant Biogene possesses a portfolio of brands, Comfy (targeting skin repair) and Collgene (targeting anti-aging) are the two drivers of their business, making up more than 80% and 15% of total revenue respectively. The disruptor status of this company in the beauty industry is also reflected in its business model where more than 70% of their sales are via online channels, and the majority of those online sales are through their direct-to-consumer stores.

Tracing back to the company’s history, it is not surprising to then understand how they have grown into its current market positioning and leadership. They were the first to obtain a patent for their technology and a medical device registration for their recombinant collagen-based product in China during the early 2000s. As an integrated business model, that involves the in-house manufacturing and deploying of various combinations from a few types of recombinant collagen. Their research and development on recombinant collagen technology is spearheaded by co-founder Dr. Fan Daidi, who has resigned from the Board in July 2023. Her husband, Mr. Yan Jianya, continues to be the company’s Chairman and CEO.

Despite the seemingly secular growth of the beauty industry in China, the heavy reliance on Key Opinion Leaders can be a double-edged sword due to the inherent reputational risks simply because of the disproportionate impact from these online influencers. Negative online claims, whether substantiated or otherwise, can lead to large swings in sales volume since consumer trust is key in this market. There have been multiple instances of these in the last five years, from allegations against Botanee’s Winona (botanical active ingredient) to the high-profile public spat between Bloomage Biotech (hyaluronic acid) and Giant Biogene (recombinant collagen).

Fast forward to the present, business environment remains challenging for many of these companies. Giant Biogene’s Comfy continues to face headwinds, with further weakness observed towards the end of 2025. Top sales channels like Tmall and Douyin will likely see difficult year-on-year comparisons during promotional events such as the Double 11, or Singles’ Day, shopping festival.

Whether sales growth can recover will largely depend on the competitive landscape in the near-term. The profitability of recombinant collagen-based products are widely acknowledged by the market, attracting significant new competition to a crucial segment for Giant Biogene.

In response to the local industry pressure and waning shopper traffic on online platforms, the company has decided to allocate more resources to expand the medical segment as well as venturing overseas. Products like KOMFYMED are in the midst of being introduced and sold in some Southeast Asian countries like Malaysia and Singapore through Watsons retail network. Offline channels are also broadening with experience-focused stores and the addition of more hospitals, clinics and chain pharmacies.

Over the longer-term, securing a key piece of the rapidly-growing skin rejuvenation market will help the company diversify its sources of income. It may be too early to tell if Giant Biogene can replicate the success of its competitor Jinbo Bio’s WyeMor, but management is likely to be confident given the preparation groundwork laid by its distribution coverage team currently.