Human Made: Can we spot a future from its past?

Leveraging on its local success in Japan, HUMAN MADE is targeting aggressive international expansion to take advantage of its rising popularity overseas.

Riding on the successful debut on the Tokyo Stock Exchange, HUMAN MADE Inc propelled the streetwear culture into the rarefied basket of publicly-listed fashion brands. As a nearly mono-brand business like Moncler and Hermes, 95% of the company’s sales come from the HUMAN MADE brand, with the rest being their CURRY UP food business. The rising brand recognition of HUMAN MADE resulted in strong brand equity and consequently, pricing power.

To understand where HUMAN MADE is positioning itself and heading towards, it is important to learn where it came from. The brand story is inseparable from Nigo, the creative director who was also deeply involved and responsible for A Bathing Ape (BAPE). While that endeavor did not, financially, end as well as expected, the brand’s prominence in its heydays cemented Nigo as a celebrity designer.

A few more career moves leading the creative directions of both mass and high fashion brands such as Uniqlo and Kenzo allowed him to deepen his relationships with industry creatives like KAWS and Pharrell Williams over decades. Especially with Pharrell Williams, their ventures spanned across multiple brands including Billionaire Boys Club and their partnership went beyond creative aspects to one of capital partner providing financial backing.

Apart from celebrity endorsements being a key part of HUMAN MADE’s brand success, taking BAPE’s past learnings and building HUMAN MADE with a commercial focus right from the start has help to sustain the brand’s profitability.

Long-term investment to drive business expansion in Japan only began in earnest after the pandemic, and during this growth period, the company managed to achieve more than 40% compound annual growth rate while expanding operating profit margin at the same time. This level of operating margin places it among the global luxury players, while growing revenue at double their pace given the lower revenue base it is currently at.

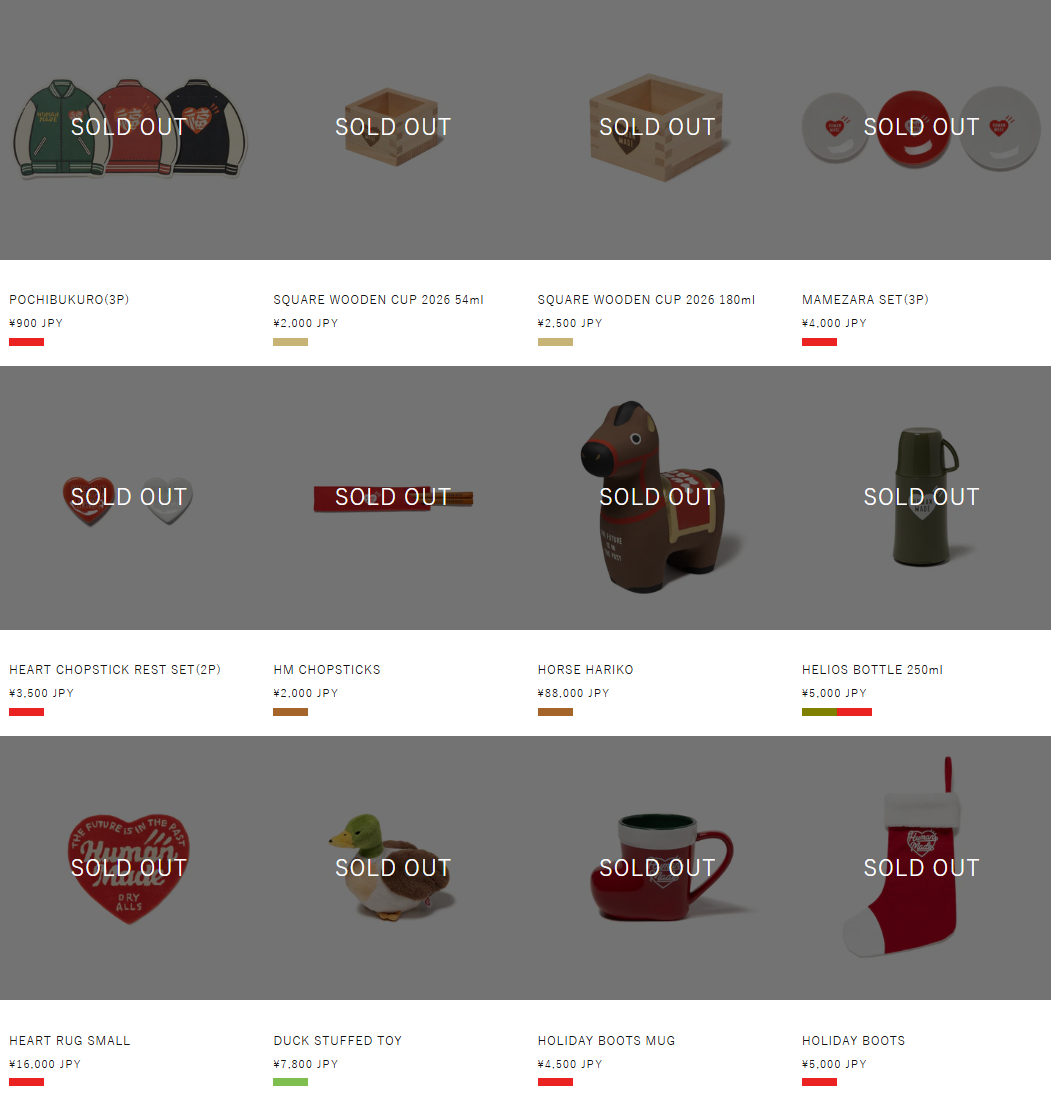

That ability to tightly control margin is driven by their direct-channel sales strategy, both with directly-operating stores and their e-commerce platform. According to the company, they achieved 100% sell-through rate with a commendable inventory turnover of only 2 months.

Leveraging on its local success, HUMAN MADE is targeting aggressive international expansion to take advantage of its rising popularity overseas. It is a common sight to see snaking queues of tourists at HUMAN MADE stores in Japan in very much the same way Onitsuka Tiger is for ASICS. Evidently, overseas sales including inbound tourist sales as a percentage of HUMAN MADE’s total sales rose from 37% a few years ago to a current high of 64%.

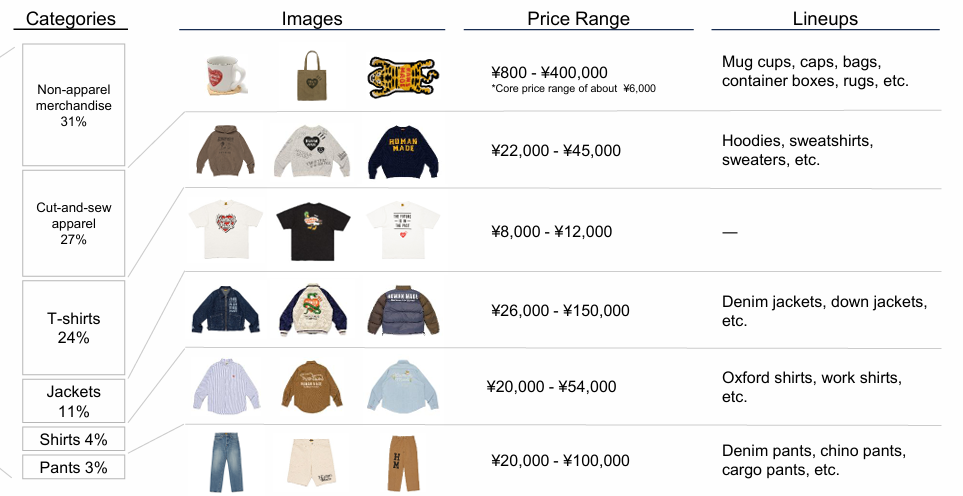

While penetration of overseas markets can supercharge growth, another aspect of demand apart from geography is the demographics. Product appeal and spending power of its customer base will vary in different overseas markets, therefore it is highly critical to be able to maintain the balance between brand positioning and an enlarged customer base.

Compared to five years ago, HUMAN MADE’s non-apparel merchandise and gender-neutral products have helped to spur the ratio of women customers from around 29% to 41%. At the same time, with most companies’ asia expansion strategy comprising of highly-populated countries like Indonesia and Thailand, HUMAN MADE is instead focused on East Asia developed economies like South Korea and China (where the perception of pop culture and information diffusion is more similar).

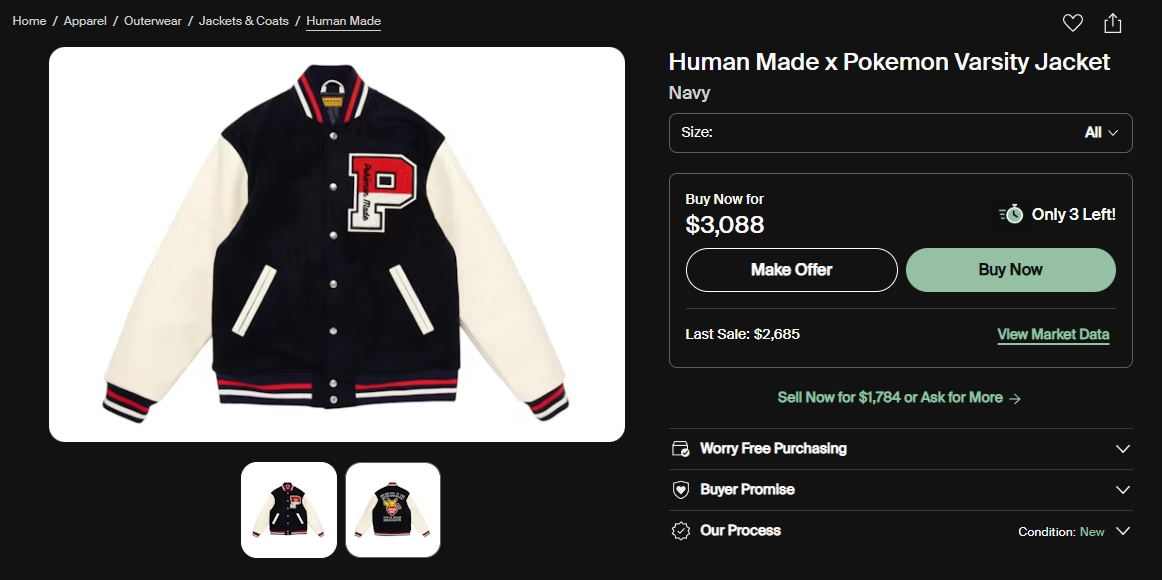

Currently, in these other East Asian markets, HUMAN MADE is operating through franchise-like agreements via stores that exclusively carry only the brand, allowing tight control of branding and pricing. On the digital front, there are also no third-party ecommerce platforms which list the company’s products apart from a small handful of selected wholesalers. However, products may be listed on the secondary markets, and those may be beneficial to the brand given the price premium often commanded on those sought-after pieces.

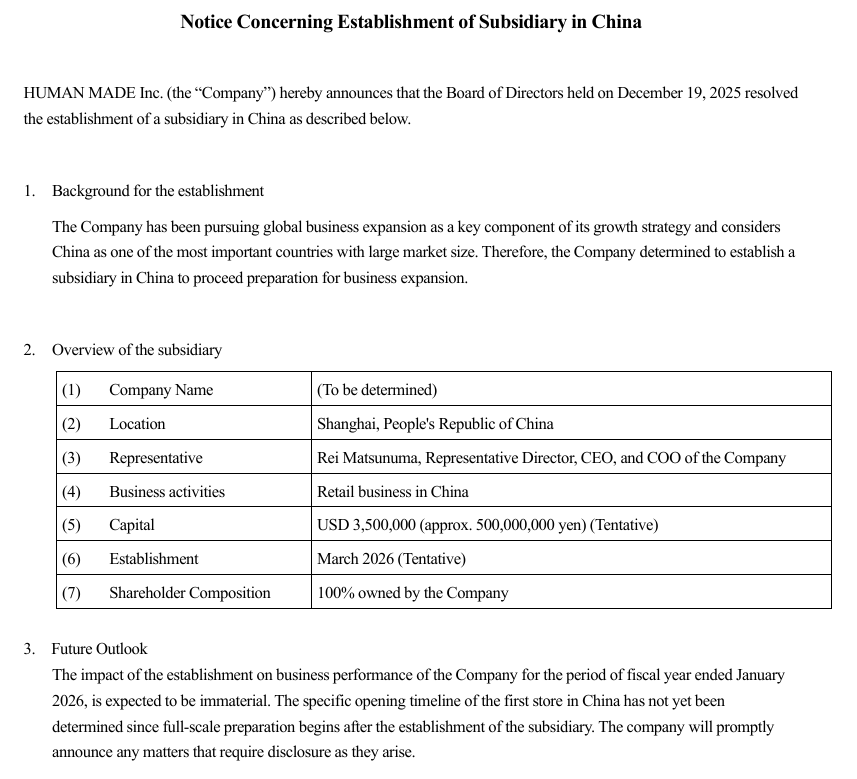

To further develop in these overseas markets, the company is making a direct move by establishing local subsidiaries. A few weeks ago, an announcement was made regarding the establishment of a wholly owned subsidiary in Shanghai to pursue business expansion in China. As of now, cross-border ecommerce between Japan and China is challenging and physical retail footprint is limited to a small store in an experimental youth mall in Shanghai. Hence, this local subsidiary will pave the way for directly-operated physical stores as well as a local ecommerce site.

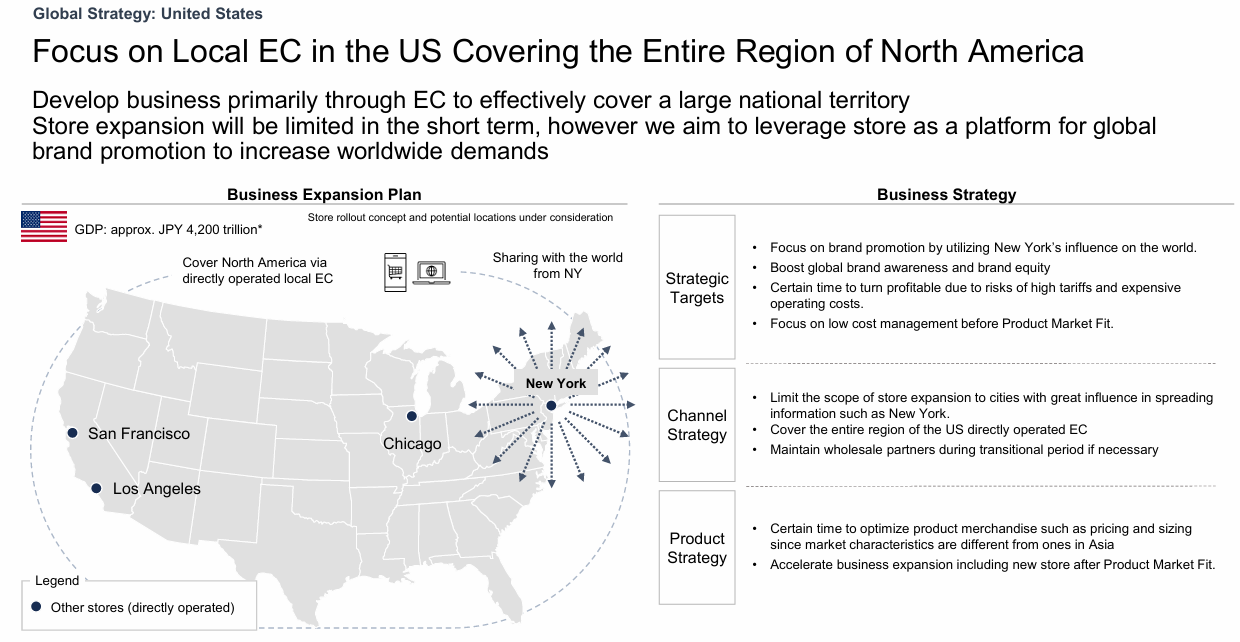

North America is another significant addressable market for HUMAN MADE. As an underpenetrated market, demand is likely incredibly high based on social media engagement relative to actual purchasing data. Adding to it is the fact that the United States is a major origin of cultural influence and largely aligned to the background of HUMAN MADE’s creative director and advisors. Henceforth, it is not hard to see why North American is high on the priority list for the company to enter in relation to marketing influence and social media. Outside of US and China, it is more likely for management to rely on lower-risk wholesale and partnerships rather than direct active management of the retail brand.

Acutely aware of how important it is to defend the intellectual property of HUMAN MADE and sustain the commercial profitability of the brand, the company management is very disciplined in balancing demand-supply dynamics while growing the brand globally. Drawing on the boom and bust of hype fashion cycles, it is certainly more prudent to take a calibrated long-term approach to growth now that they are a listed company. Riding on the runaway success of HUMAN MADE, it is not unreasonable to expect the team behind it all to promise a brighter future than its past.