i-Tail Corporation: In for a treat

Facing policy-induced trade uncertainties, the bigger question for i-Tail Corp is how the company can position itself to extract higher value from the global industry chain.

The explosion in popularity of pets as companions during the pandemic has continued to linger on for a few years now, with not less attention paid to fur animals like dogs, cats, and rabbits. As a direct result of this, many pet-related services have sprouted and pet food businesses boomed too.

Pet owners are becoming more willing to splurge on relatively expensive pet treats, viewing pets much more like a close family member. Globally, pet food demand is likely to continue growing at an annual compound growth rate of mid single-digit. US remains a large market globally for the pet food industry, and many of these products are imported from Asian countries like China and Thailand. Thailand in particular, has been trying to grow its market share, exporting into major pet economies like the US, Europe and Japan.

However, with almost 70% of the pet food cost being raw materials, ingredients, and packaging, the industry is one that is highly susceptible to cost inflation. With US-led tariffs potentially disrupting the supply chain, freight and transportation cost will continue to affect the exportability of these pet food.

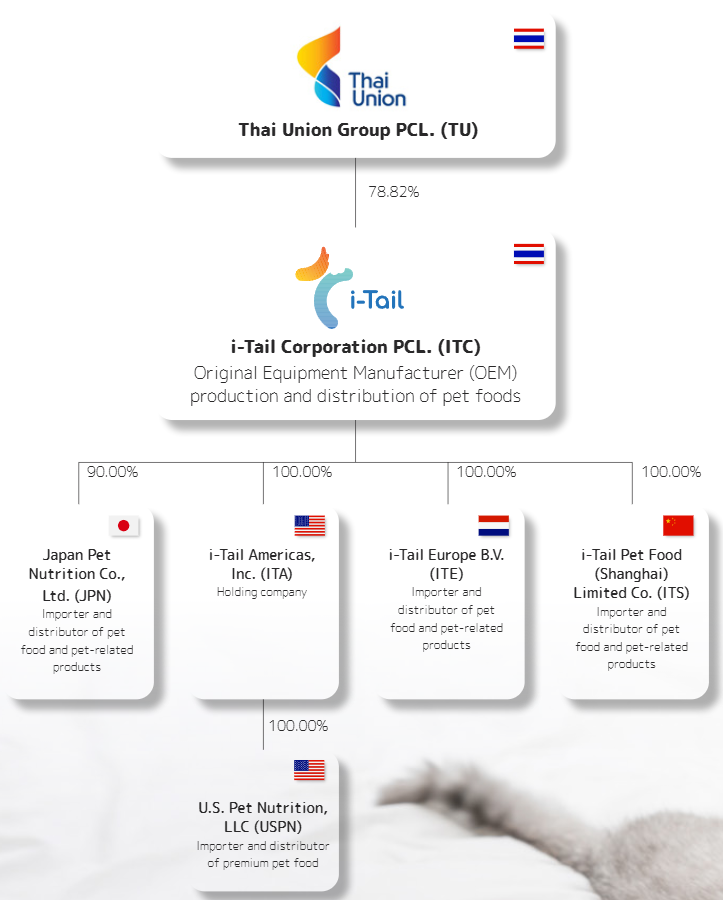

Specifically for i-Tail Corporation, tuna makes up around 18% of their cost, followed by broiler at 11% and others like beef, lamb ribs and salmon at 7%. With its roots traced back to Thai Union Group, an established supplier of food in Thailand, i-Tail Corp should be able to navigate supply chain disruptions effectively by tapping on the expertise of its parent company as a global food exporter and OEM. Thai Union currently still owns almost 80% stake in i-Tail Corp.

Understanding that commodity costs are volatile and can be subjected to wild swings, i-Tail Corp has decided to commit more resources in improving productivity through optimisation as well as pursuing more business development opportunities. Announced as Project Tailwind, the transformation program seeks to increase the company's operating profit by around US$50m starting 2027 by focusing on reaping efficiencies from the three identified areas of commercial development, manufacturing, and procurement.

In the longer term, to eventually achieve their goal of US$1.5b annual sales by 2030 (given current sales of approximately US$500m in 2024), it is likely that the company has to consider both organic and inorganic growth through acquisitions to realise its ambitions.

i-Tail Corp's portfolio of five pet food brands include Bellotta, ChangeTer, Marvo, Calico Bay, and Paramount, with the last two being export brands catering to the US markets. The company specialises in wet pet food and treats for cats, with two production facilities in Thailand. In addition, they possess research and development capabilities to further innovate their offerings, contributing to product assortment and premiumisation. Scoring another global customer in 2024, they now work with four of the top-five global pet food companies.

As households reel from the rise in cost of living, it is natural that pet owners may dial back on spending on premium pet food and treats. As a manufacturer in this demand environment, i-Tail Corp may need to further collaborate with pet food companies to provide budget-conscious consumers with better value proposition. Towards this end, the company recognised the need to broaden and differentiate its products in terms of functionality and nutritional content. The development of these food formulae can range from boosting pets' digestive and immune system to strengthening muscles and dental health.

As for distribution channels, households with reduced spending propensity may also trade downwards in terms of both basket size and cheaper alternatives from branded labels to economical private label brands. The US market, which has historically been strong, is seeing tapering growth with pet ownership slowing. At the same time, US pet owners are also more receptive to online e-commerce channels to purchase pet food compared to their European counterparts which are still more used to traditional formats like supermarkets. In response, i-Tail Corp is working on diversifying its customer base, making strides in expanding its revenue share of private label customers as well as inroads into emerging markets like South America.

With operational performance turning around from 2023 and management expressing confidence over its Project Tailwind implementation in the coming few years, markets may look past the short-term softness and gain clarity on the underlying structural drivers of the business.

Pets continue to serve as an emotional connection to many globally, while ownership is likely to remain steady in the traditional mature markets of US, Europe, Japan and Australia. What is changing is the competitive landscape and the business model of players in the pet food industry.

While latest policy-induced trade uncertainties can be a headwind to exporters like i-Tail Corp, the bigger question is how the company can position itself to extract higher value from the global value chain. Solutions to a more durable business moat definitely extends beyond more than supply chain and procurement resiliency, requiring a deeper reimagining along the lines of demand creation and possibly a science-based approach to pet nutrition and diet.