Klook Technology: Can this Asia experiences platform achieve five stars right out the gates?

A key differentiating factor for Klook is their focus on hyper-localised activities and experiences in the Asia region, with its ease of usage resonating strongly among young travelers.

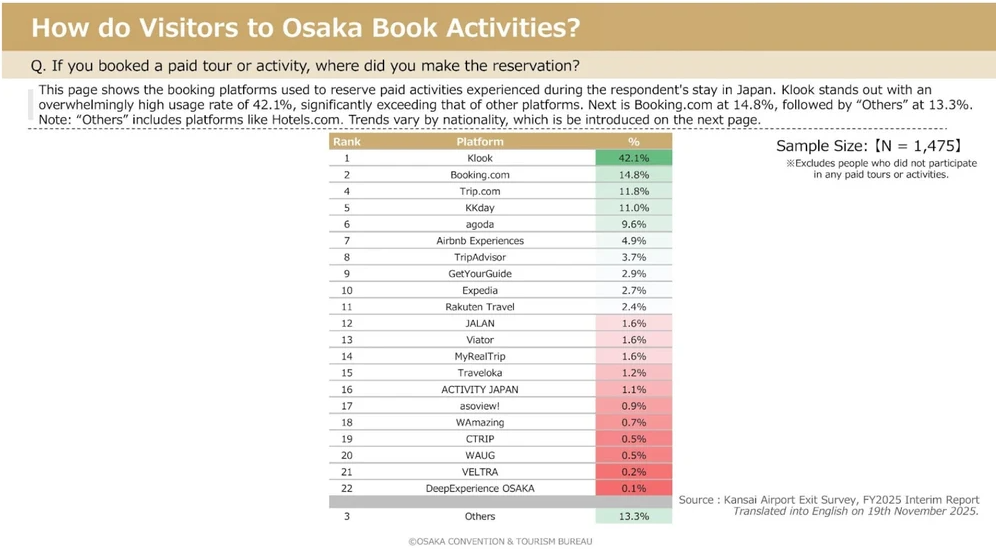

With no lack of online travel service providers, Klook is entering a very crowded field. However, the company has managed to stay competitive and even grow substantially in the face of its larger and well-capitalised peers.

A key differentiating factor for them is their focus on hyper-localised activities and experiences, where operators on the ground are independent vendors in the fragmented travel market of Asia Pacific. For many travelers who may face barriers like languages and local walled ecosystems in online ticketing and payment options, Klook simplifies much of the process.

Similar to the depth of Ctrip services in China, a whole range of activities, transportation and even accommodation can be booked on Klook platform for major markets such as Hong Kong and Japan. Going beyond integrating established vendors for ticket sale like Disneyland and well-known tourist attractions, what makes Klook’s platform comprehensive is their onboarding of small independent vendors such as even local ferries on a small island in Thailand.

If anything, Klook has its work cut out for them by the surging popularity in both intra-region and domestic travel within Asia. Revenge travel post pandemic has turned into a longer-lasting trend, where travel experiences have become a mainstay of people’s lives. Across the value spectrum, short getaways are now almost a necessity, while higher-end luxury trips become a justifiable reward for many who may deem the cost to be not worthwhile previously.

By integrating payments and partners throughout the region, Klook is a key enabler for a more seamless travel experience via its digital platform. Spontaneity plays a big role in attracting its current target audience. Instant online confirmation and redemption of major tourist attraction and transportation tickets is a strong feature attracting the younger digital-savvy demography. That allows for skipping of snaking queues or confusing physical ticketing procedures from things like airport transportations to popular teamLab exhibitions.

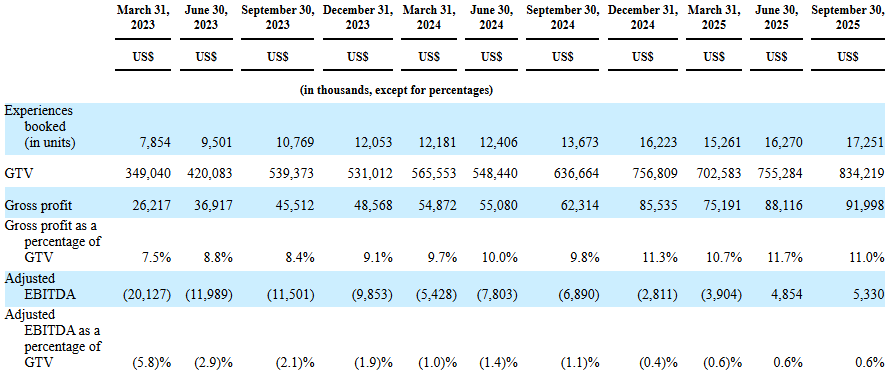

The growth in the business’s numbers speaks to this fact. At the bookings level, Klook is sustaining around 30% annual increase after a 156% year-on-year surge in 2023. Gross transaction level grew slightly faster over the same period. This points to higher average price per unit of experiences booked on the platform. From about averaging US$42 per experience in 2022, the price increased to US$46 in 2024.

Accounting for the cost of service, Klook’s gross profit as a percentage of gross transaction value improved from 6.9% in 2022 to 10.3% in 2024. As we near the end of 2025, it is possible for this take rate to expand between one to two percentage points for this year.

This is by design due to the business model. As its operations scale up, it is only natural that top line growth will slow when majority of partners and vendors have been onboarded onto the platform. However, bargaining power will shift towards the platform as adoption increases and Klook can in turn extract higher value from transactions done on its platform through the take rate (or lower cost prices if Klook takes on the inventory for direct selling).

In their current expansion phase, volume growth is still essential so it is reasonable to think that they will be focusing a lot more initiatives on both acquiring partners to increase the supply of experiences available as well as demand creation investments to attract users. As of September 2025, the platform consists of around 310,000 offerings with more than 10 million annual transacting users.

Unlike many emerging growth companies which may be many years away from profitability at the EBITDA level, Klook is operating at a gross margin of about 63% and making a slight operating loss as a result of substantial selling and marketing expenses.

These expenses are pretty controllable and can taper down if the company is confident that the savings can more than positively offset the decline in revenue growth. In fact, adjusted EBITDA (as defined by the company) turned positive at US$6 million for the first three quarters of 2025. This translates to 0.3% of gross transaction value.

Klook first filed its registration statement on F-1 form for a proposed IPO on the New York Stock Exchange last month. However, as market conditions turned choppy and with the year end fast approaching, the company has delayed its listing plan to early 2026. Given this set of robust financial performance, it is probable that Klook is looking to IPO at a valuation of nearly US$4b.

Even though the company has offices in 18 geographical markets, it was not until 2018 when the company formally ventured into North America and Europe. Even so, more than 80% of the gross transaction value is still generated in Asia Pacific this year. That makes the IPO a predominantly Asia travel story for now, a regional platform which directly competes with the likes of Trip.com and Airbnb Experiences.

With spending on experiences taking off in Asia, Klook being the home-grown platform in this region positions itself to be the category leader powering this trend. Short-form travel videos and Klook’s mobile digital booking further enabled the company to become the platform of choice by Millennials and Gen Z travelers. The prospect of experiential travel forming a core spend for the younger generations and Klook gaining wallet share from this shift may be enough for this IPO to be well-received if and when the listing comes through.