LG Chem: Peak capex transition into a low-carbon era

Anchored by its mature petrochemical business, LG Chem is refueling its growth bets in energy solutions and life sciences. Meanwhile, South Korea corporate reforms can help unlock shareholder value.

As a pioneer in the petrochemical sector, LG Chem once paved the way for post-war South Korea in the export-led industrialization era. Concurrent with the rise of Lucky Goldstar (now “LG”) into a prominent chaebol, the chemical business itself expanded into many fields at the same time, notably in the energy solutions space. As the alternative energy portfolio widened, LG Energy Solution (“LGES”) was spun off in 2020 with LG Chem retaining around 80% stake in the company.

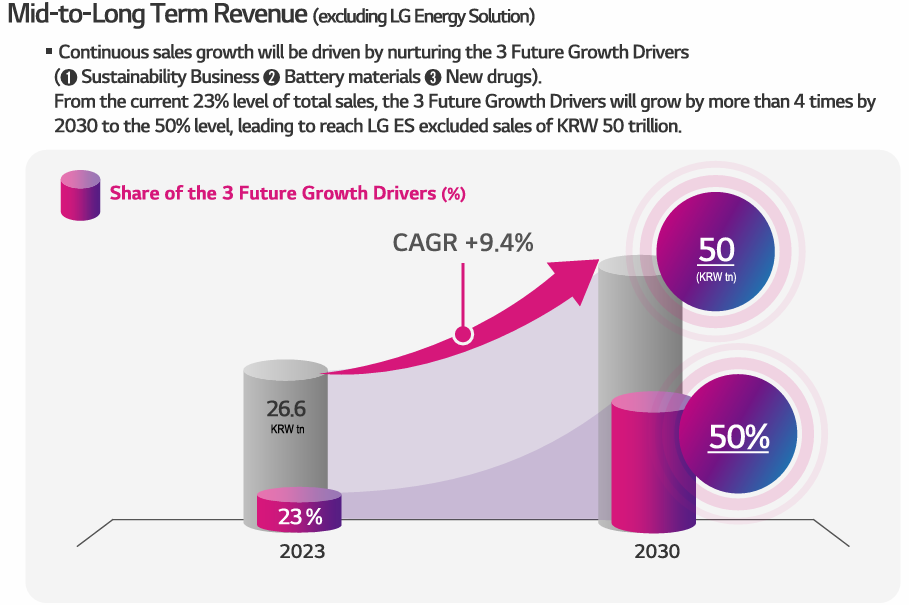

Anchored by its mature petrochemical business, LG Chem is refueling its growth bets in energy solutions and life sciences. A prolonged slump in the petrochemical complex due to oversupply issues in the past years has hastened this pivot, with the company committing to large-scale capital investments in battery materials. As a result, this current investment phase has pressured profitability and the dividend payout to a certain extent. However, management has urged shareholders to look beyond this transition by setting a ROE target of at least 10% from 2028.

To achieve its ambitions, government policies definitely have to be favorable towards LG Chem. In recent times, South Korea has followed Japan footsteps in enacting corporate reforms, not just targeting legacy conglomerates operationally but also to steer regulations towards corporate governance friendly to minority shareholders. In the stock market, South Korea is attempting to address the ‘Korea discount’ which has plagued the valuation multiples of KRX-listed companies. Further momentum in these value-up initiatives can certainly help LG Chem, be it in terms of tax incentives, restructuring support or even subsidies to spearhead the company's exports.

Turns out, as one of the global market leaders in battery and battery materials, the United States’ Inflation Reduction Act (including the follow-up modifications in the One Big Beautiful Bill Act) helps deliver a cost advantage to LGES and LG Chem. Besides EV batteries, the key to gaining US market share therein lies in LGES’s Energy Storage Systems (“ESS”) which are made in the US. These clean energy projects which began before the One Big Beautiful Bill can tap on up to 40% investment tax credits (“ITC”). Moreover, energy storage is also less affected than the wind and solar projects which are targeted by the Trump administration.

In addition, the 45X Advanced Manufacturing Production Credit (“AMPC”) can still effectively be stacked on top of the 40% ITC, leading to advantageous price competitiveness for US customers choosing to go with LG Chem. With further limitations imposed on the sourcing of critical materials from ‘prohibited foreign entities’, LG Chem may stand to gain from its Chinese competitors like CATL.

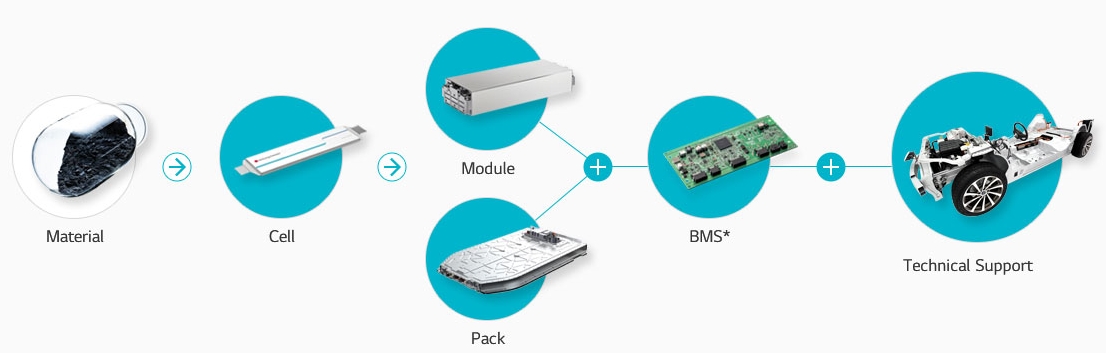

Apart from residential and utility-scale battery ESS, the company’s exposure to EV batteries for automakers cannot be overstated. Earlier this year, GM has announced a US$19b long-term contract through 2035 for LG Chem to supply cathode materials to its battery cell plants (including Ultium Cells, a joint venture between LG Chem and General Motors).

That said, existing uncertainty around trade talks and auto-sector specific tariffs have led to more conservative inventory management of leading auto OEMs. Regarding end demand of EV users, adoption may stall due to policy rollbacks from the Trump administration. On top of an accelerated phasing out of consumer tax credits for purchases of EVs, there is also the removal of civil penalties for corporate average fuel economy (“CAFE”) standards. Apart from removing the need to purchase CAFE credits, traditional OEMs can also be spared from adopting CO2 emission-reduction technologies if greenhouse gas emission laws are relaxed, which will further slow EV capex spend.

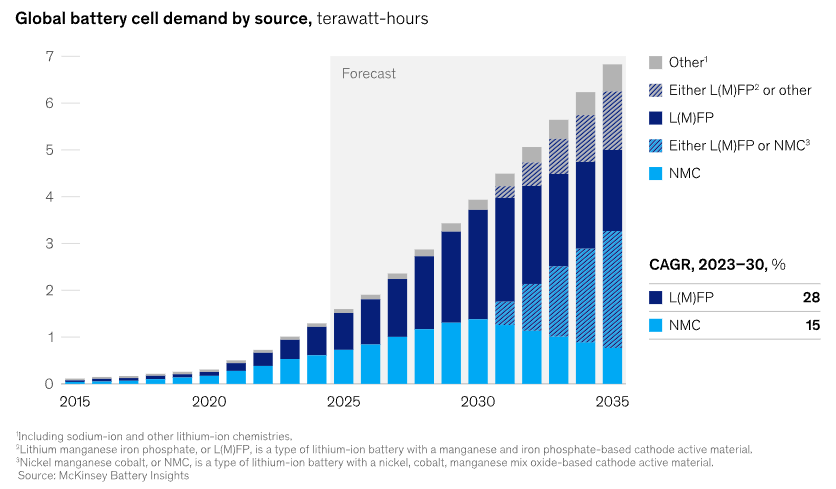

Within this macroeconomic context, LG Chem can push ahead by partnering customers to develop EVs targeting the mass market. This may help to cushion some of the slowing EV demand from higher-end models. In fact, Ultium Cells has already announced that it will upgrade the Tennessee plant to convert and scale up production of low-cost lithium iron phosphate (”LFP”) battery cells. These will be used in more affordable EV line ups. Another potentially high-profile customer, Tesla, is also said to be in talks with LGES in a US$4b deal to source LFP batteries, likely for ESS applications.

Therefore, despite the near-term overhang of trade uncertainty and EV adoption, what is clearer for LG Chem is twofold: the cyclical commodity recovery in their petrochemical business as well as the competitive edge over Chinese competitors in the US market. In light of this, the ensuing earnings inflection, coupled with South Korea’s corporate and market reforms, bode well for LG Chem as the company reinvents itself for a low-carbon decade.