Prudential: Buybacks and dividends back in force

Prudential management has signaled confidence in the recovery of its underlying insurance operations, supporting the case for higher dividends and share buybacks.

Prudential, despite being one of the largest Asian insurers, has been underperforming its peers for the past few years. There are several reasons for this, including competitive pressure on pricing as well as elevated costs. Other pan-Asian insurers such as AIA and Ping An Insurance also have a bigger exposure to the Chinese market compared to Prudential. The lowering of monetary policy rates in the China market probably drove more customers to seek out higher returns elsewhere, including through investment-linked insurance products.

However, in the last few months, there have been notable changes in Prudential’s corporate developments. Not only is there currently a reshuffling of senior management, the company is also embarking on capital markets-friendly initiatives through dividends and value-unlocking exercises. Following the departure of Solmaz Altin, Naveen Tahilyani was appointed the new regional CEO covering markets like India as well as looking after the Health business. Another regional CEO, John Cai, will cover Southeast Asia markets and have oversight over the Agency business. On the asset management side, Rajeev Mittal is also replacing Bill Maldonado as CEO of Eastspring Investments comes July 2025.

With Prudential having been spun out of M&G in 2019 and further carved out from Jackson Financial in 2021, the company is now laser-focused on its Asian operations and expanding in its priority markets of mainland China, Hong Kong, Singapore and India.

Recently, there has also been news that ICICI Prudential Asset Management Co, in which Prudential owns 49% of the JV company, is on its way towards an IPO filing. Proceeds from a successful listing of this India business can potentially be distributed back to Prudential shareholders, crystallizing some of this value from the stake sale.

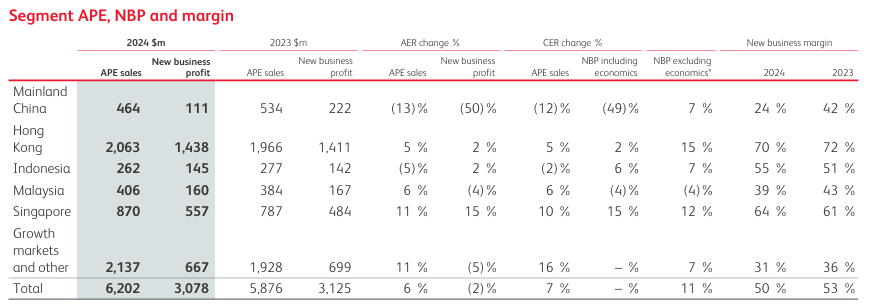

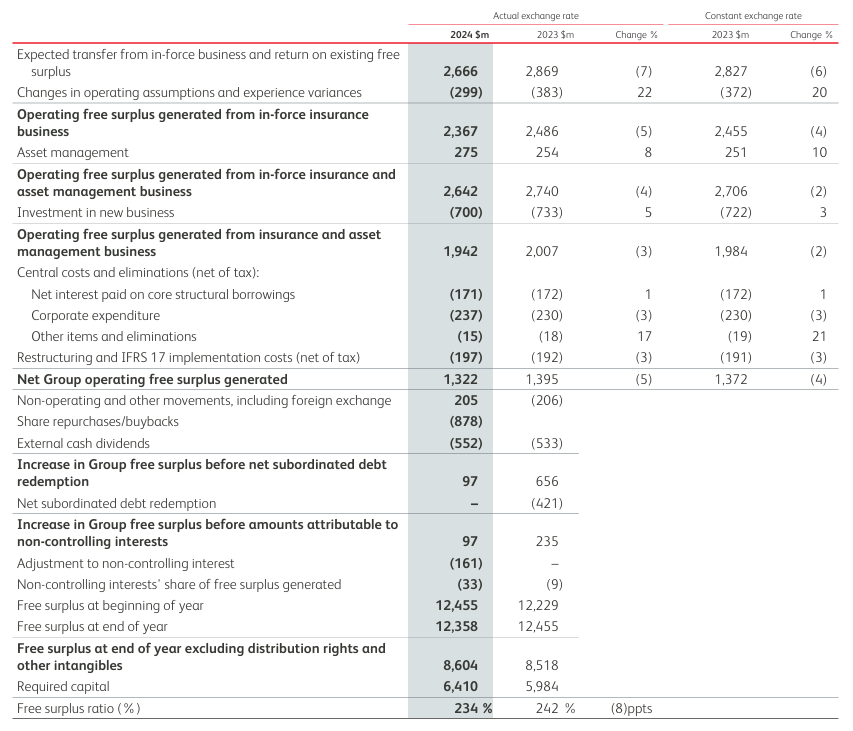

More importantly, Prudential management has signaled confidence in the recovery of its underlying insurance operations. Supporting the case for higher dividends and accelerated buyback program is the underlying growth expected from new business profits driven by improved mix and pricing. More specifically, gross operating free surplus generation may be able to achieve more than 10% growth this year based on the current in-force insurance business and a compound annual growth rate of nearly 20% by 2027.

What has been less certain and remains an important moving part is the operating variances in the path to its operating free surplus growth. Historically, Prudential has been weighed down by negative operating variances but there is indication that management is taking a more engaged approach to managing the operating variances. More details may be shared by management in the coming months, including capital management initiatives such as dividends. For now, markets seems to be cheering this inflexion point for Prudential.