Riverstone: Steady hands through boom and bust

As a Malaysian glovemaker, Riverstone has weathered the industry downturn relatively well so far, with superior balance sheet and capital allocation throughout the years.

One thing characterizes the gloves industry: Production oversupply and low pricing power of what is essentially a commoditized product. A global pandemic and fleeting export-import regulations caused much optimism and subsequent disappointing impairments in a tumultuous business cycle for major glove producers.

In this region, Malaysia, China, and Thailand ranks amongst the top-producing countries globally. Given the broad categories of gloves in general, Riverstone specializes in nitrile gloves in cleanroom environment like semiconductor and electronics manufacturing to position itself in the segment of higher-end gloves. This differentiation allows them to dampen the volatility which can affect latex or vinyl gloves more.

Riverstone has weathered the industry downturn relatively well so far, with superior balance sheet and capital allocation throughout the years. Their high-quality cleanroom gloves are also buoyed by a demand recovery from customers along the semiconductor supply chain. While it remains to be seen if this is just a cyclical rebound or a new structural tailwind led by AI, the company may be able to at least enjoy a near-term boost as these high-tech cleanroom gloves is traditional a space with high barriers to entry.

Grappling with intense price competition in the generic healthcare gloves segment, it is imperative for Riverstone to accelerate their transition into a high-spec solution provider in order to protect themselves from the longer-term industry margin erosion in the face of Chinese suppliers. Clients with customised orders are less likely to switch suppliers and often, these customers are in high-growth modern industries like semiconductors and pharmaceutical. Riverstone can better ride upon their growth instead of engaging in a race to the bottom for generic gloves.

A potential contributor to short-term industry noise is the uncertainty surrounding trade tariffs. Even before the trade deal which was forged between US and China in mid-2025, Malaysian glovemakers had seen their share prices swung wildly against the confusion of an exact tariff rate imposed on Malaysia-sourced gloves imported into US. To circumvent future trade tensions, Chinese producers are also diversifying their manufacturing bases into Southeast Asia, competing directly with regional producers. In this light, trade policies play a consequential role in whether Riverstone can defend its market share and withstand the pricing pressure of lower and lower landed prices of Chinese gloves in the US.

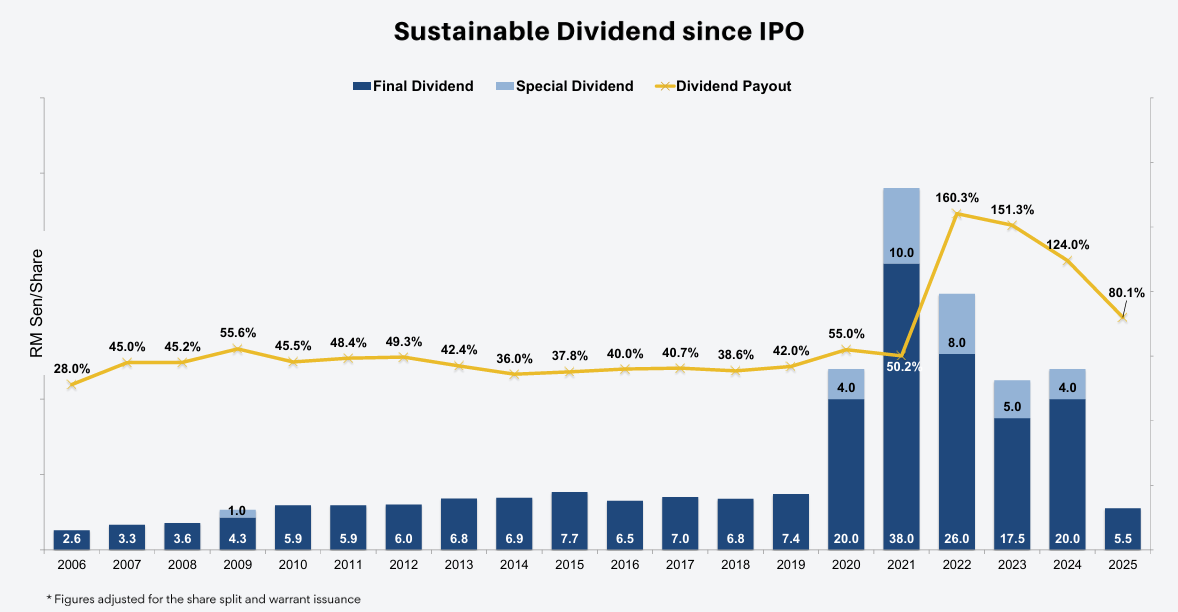

With macro conditions as mixed as it has ever been, it is Riverstone's capital discipline which can provide comfort to the markets. A net cash position and uninterrupted dividend history should be able to sooth some nerves while maintaining the optionality to increase capex to capture emerging opportunities.

What sets the company towards a sustainable path is to not be distracted from sudden spikes in glove prices, extrapolating the demand dynamics and speculatively building production capacity. That has proved to be value-destroying the past few years and was unfortunately a costly lesson for many of its glovemaker peers. In this industry, it is the unflashy and relentless cost discipline that reigns over crowd exuberance and aggression of newly-commissioned lines.