Shiseido: A balancing act to reignite growth

China and travel retail is key to reviving the sales and operating leverage of Shiseido. Recent transformation programs present some green shoots for a turnaround next year.

Long been a key hub for experimental trade and investment policies, Hainan Island will once again be expanding its role as a conduit in China’s dual circulation policy comes December 2025. Known as a special Customs regulatory area, the southern Hainan province will launch a comprehensive zero-tariff system, significantly widening a list of product categories eligible for exemption from import duties, value-added tax and consumption tax.

This new Hainan Free Trade Port with its independent customs regime can likely rejuvenate economic activities on the island and help spur duty-free shopping, which has been hit extraordinarily hard the past few years in the travel retail slump.

With China extending its visa-free policy late last year, Hainan now allows visa-free access for individual visitors from 77 countries. Coinciding with the formal status of this Free Trade Port on 18 December 2025, the island will further open up visa-free access to 85 countries, supercharging international tourist numbers (which have already been growing strongly through the first half of 2025).

Shiseido is not new to the rapid development of Hainan. With its first duty-free counter on the island as far back as 2010, the company has been committing to its travel retail strategy there by launching six new brands at Haikou International Duty-Free City in 2022.

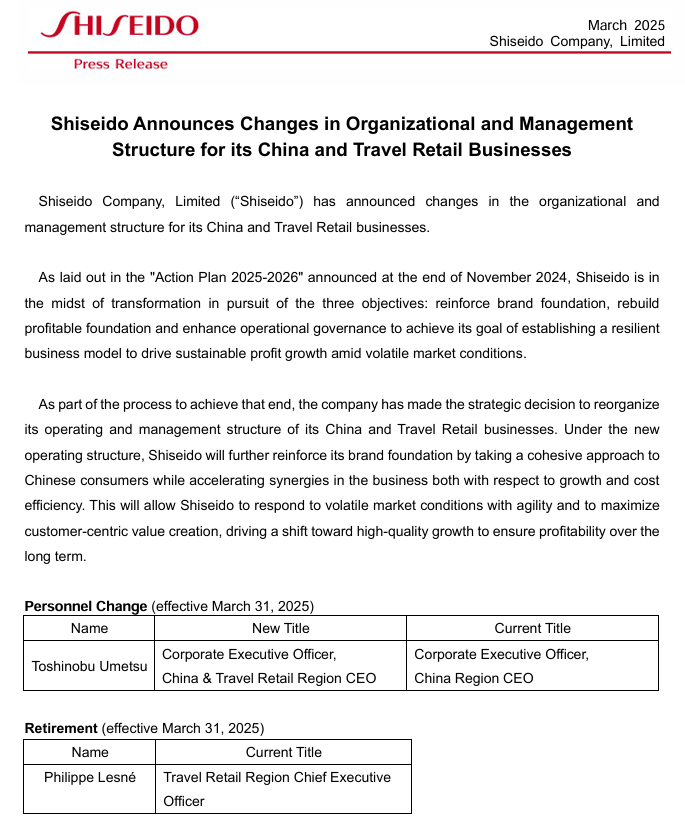

While their ‘SHIFT 2025 and Beyond’ strategy has since been challenged by the ongoing travel retail weakness, the management is responding to the sales slump with an organizational overhaul of the China and Travel Retail business under the corporate-wide transformational initiative called ‘Action Plan 2025-2026’. Philippe Lesné has relinquished his role as regional CEO and Toshinobu Umetsu (the existing China regional CEO) has started to oversee the combined China and Travel Retail as one business from March 2025.

China remains a key market for Shiseido, being its largest outside their home market in Japan. China performance has also been the reason for the profit downgrades by the company and thus, the added investor pressure to turn around the business.

With a board reshuffle resulting in a new Chairman, and also a new Group CEO since January 2025, much is at stake for the company to prove that it can survive this industry crisis and remain a relevant beauty brand globally. A refreshed Medium Term Plan is slated to be announced by the end of 2025 and attention will be focused squarely on the ability to engineer a recovery in profitability through Shiseido’s mature brands and markets.

More importantly, there is an urgent need to instill renewed confidence that the Group’s return on invested capital can be back above its weighted average cost of capital and subsequently on track to trend towards global peers' double-digit levels.

Operationally, as the company’s new management executes on its current plan to reap more cost efficiencies in their main market of Japan, this is also an opportune time for them to develop their digital marketing capabilities. In US, trade tariff flux also means that Shiseido has to rethink its supply chain amidst production issues and them ceding market share at the moment. On the China front, the declining brand equity has to be arrested with further commercial investments made to re-engage with consumers with fleeting behaviors and preferences. Regarding their portfolio, while some brand positioning like Drunk Elephant remains questionable, there are signs that Shiseido is willing to double down on their main brands (SHISEIDO, Clé de Peau BEAUTÉ, NARS).

In this transition phase, Shiseido does need to balance between aggressive cost-cutting and investing in their portfolio of brands. With much of the macro headwinds behind them, the worst of this pivot may be over. A corporate transformation of this scale is certainly not a quarter’s work. Clearly, if there is one area which can move the needle for them in the near term, it is the China and Travel Retail performance turnaround; and what is truly required is a singular coordinated price control strategy to fend off discount competition and rebuild brand quality.